Are investment bankers evil, or just misunderstood?

The press aren’t fans of investment bankers, and the feeling is mutual. So when I asked a few to talk to me about their lifestyle, I didn’t think it’d go very well.

Look up ‘banker’ on Urban Dictionary, and if you are one, you’re not going to like what you find: ‘Engineer of genocide’, ‘the first up against the wall when the revolution comes’, ‘politer version of w*nker’. Search ‘headlines bankers’ on Google images, and you won’t be much happier: 'SCUMBAG MILLIONAIRES', 'GREEDY BANKERS STILL DON’T GET IT', and 'PUT BANKERS IN THE DOCKS.'

It’s pretty clear: People don’t like bankers. And yet, people still want to be bankers. The biggest banks – Goldman Sachs, JP Morgan – get hundreds of thousands of applications, and only accept around 3 per cent. Applications to Deutsche Bank’s investment banking division went up by 15 per cent just in the last year.

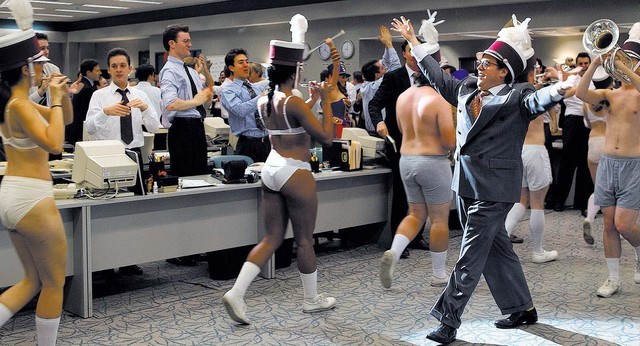

So what’s the deal? Are bankers evil, or just misunderstood? Is it really as crazy as the The Wolf Of Wall Street makes it look, or is it just a bunch of maths-y guys in suits working long hours? Did bankers cause the crash, or did we? I decided to do a bit of myth-busting, and went on a hunt for investment bankers willing to talk.

I was expecting a lot of very short phone calls – “No, we’re not w*nkers. Yes, we do earn a lot. No, we didn’t cause the crash.”

But it turns out bankers have a lot to say about what they do. They’re conscious of the fact that people don’t like them much, frustrated with the fact they get all the blame for the financial crisis, and kind of wish that the media would just get off their back.

"They think we're sitting around plotting how to become rich," said James, a newer recruit to one of the biggest players in the financial world. “People think we’re scum,” Richard says, who’s worked in the industry all his life. “I think it’s just envy. We did earn too much money… that’s probably the root cause of it.”

Unsurprisingly, money came up a lot in my calls. Bankers are notorious for their bonuses – extra cash they get on top of their salary based on how much money they’ve made for the firm that year. “Generally, my bonus is between 25 and 75 per cent of my salary,” said Jeff, an investment banker based in the US. “But I’d freak if it dropped below 40 per cent, actually. It can go up to 200 or 300 per cent, depending on the firm.”

So how much is too much? “It’s a misconception that our salaries are outrageous,” argued Henry, who works at a hedge fund in London. “If I drive a purchase for the company, I’ve created a huge amount of value, and I’m only taking home a tiny part of it in comparison. And that wealth I’ve created could be your grandmother’s pension, or something. So it might seem like a lot in comparison to other jobs, but compared to what we make for the company, it’s not that outrageous.”

“I’ve created a huge amount of value for the firm, and I’m only taking home a tiny part of it. And that wealth I’ve created could be your grandmother’s pension, or something. ”

And to be fair, the six figure salaries are probably the motivator behind those hundreds of thousands of applications to the industry every year. “Status-wise, a lot of people think it’s one of the top places to be,” says Melissa, who worked at Lehman Brothers in 2007 but left just before it collapsed. “You earn way more than you would in any other job right out of university - or you did back then, anyway. I’ll never earn that much in one year again. It’s a ridiculous sum.”

Not to mention the work expenses. Most people tried to assure me the Wolf Of Wall Street, Margot-Robbie-in-a-bubble-bath image is totally false... but from the stories they told, it didn’t sound quite like your average five pounds for lunch kind of set-up. “In my first year there, we went out to a bar in Mayfair, and they put me up in a boutique 5 star hotel around the corner right afterwards, even though I lived in London. It was totally unnecessary,” Melissa said.

“I heard a girl I used to work with dropped $1000 on in-flight drinks on a flight from LA to Manhattan,” said Jeff. “She must have been buying rounds for the entire cabin.”

But it’s not as sweet as it sounds. What you gain in glitz and glamour, you lose in work-life balance. “I’d pass out, wake up, rinse and repeat,” said Jeff. “The industry tends to murder its young employees with work because they never stand up for themselves. Then they kick the weak or stupid ones to the curb.” Average working days seem to be anywhere from 14 to 19 hours, and one person said Sunday all-nighters were pretty much a given.

“We had a coffee shop inside the bank,” Melissa said. “And when I was relatively new, I literally just got up from my desk to get a coffee, and took about five minutes, but I didn’t take my Blackberry. And when I got back, the whole team was like “ ‘How were you not responding to our emails?!’ You’re always expected to be on call, like it’s an operating theatre.”

““The industry tends to murder its young employees with work because they never stand up for themselves. Then they kick the weak or stupid ones to the curb.” ”

This stuff differs firm to firm, and it’s got better since the crisis, most said – but not much better. Tom, another London-based banker, told me about one firm who tried to fix things by stopping people from logging into their computers on Friday evenings, but they ended up doing all the work on Sundays instead. As James put it, you’re expected to be “constantly committed to the job, day and night”.

The sad thing is, it doesn’t sound like it’s totally necessary to be there day and night. “Literally, robots could do 50 per cent of what we do,” says Tom. “But it’s such a technologically averse industry. Every time a new technology comes in, a senior person is like, ‘I remember the days when we had to do this ourselves.’, and they want you to go through the same pain. And there is a lot of waiting around.”

I’ll be honest. Six interviews in, I wasn’t sold on the job. But then again, who cares? Live and let live, right?

Well, no. The reason we’re so engrossed by banker lifestyles isn’t just because we’re amazed / disgusted by / jealous of the extravagance - there’s the whole it-might-have-caused-the-crash thing. And if it did, it’s definitely my business to find out how, and why, and whether things have changed enough to make sure it doesn’t happen again.

“Literally, robots could do 50 per cent of what we do. ”

But most of the people I spoke to don’t feel like they did cause the crash, and resent the fact that most everyone else disagrees with them. “2008 destroyed us,” Richard said. “But the idea that the person who took out the loan is just as much to blame as the guy who gave it to him is politically tricky. People wanted to live beyond their means.” Jeff’s on his side: “You could easily blame the consumers that took stupid mortgages they’d never be able to repay… everyone was just maximising their own profits. And the system had a snag, and everyone tripped.”

The thing is, a lot of the loans and mortgages people are talking about were sold wrapped up in so much jargon that a lot of people genuinely didn’t understand what they were getting themselves into. So whose fault is that? “Look, CEOs are cogs in a profit machine,” Jeff reasoned. “It’s their job to be cutthroat and profitable, otherwise they’d be social workers instead of CEOs.” Henry agrees the blame shouldn’t lie with the banks alone: “People should have thought more across the system,” Henry said. “Is it really the bankers’ moral obligation to tell a borrower they can’t afford it?”

So there it is. Six figure salaries, yes; glamorous nights out, sometimes; sole architects of the 2008 financial crash, undecided. But what’s certain is that bankers – or at least the ones I spoke to – are totally aware of their bad rep among the public, and genuinely wish people understood what they do better.