Tesla CEO Elon Musk showed a bit of attitude on a conference call, and his shares fell by 5 per cent as a result. Oops.

What it means: Most private companies are valued in shares, where people invest in a portion of your firm and get a proportional share of the profits if you do well. But shareholders can be fickle, and they clearly didn't think much of Musk calling an analyst a 'boring bonehead' in a conference call, saying the 'dry' questions were 'killing' him.

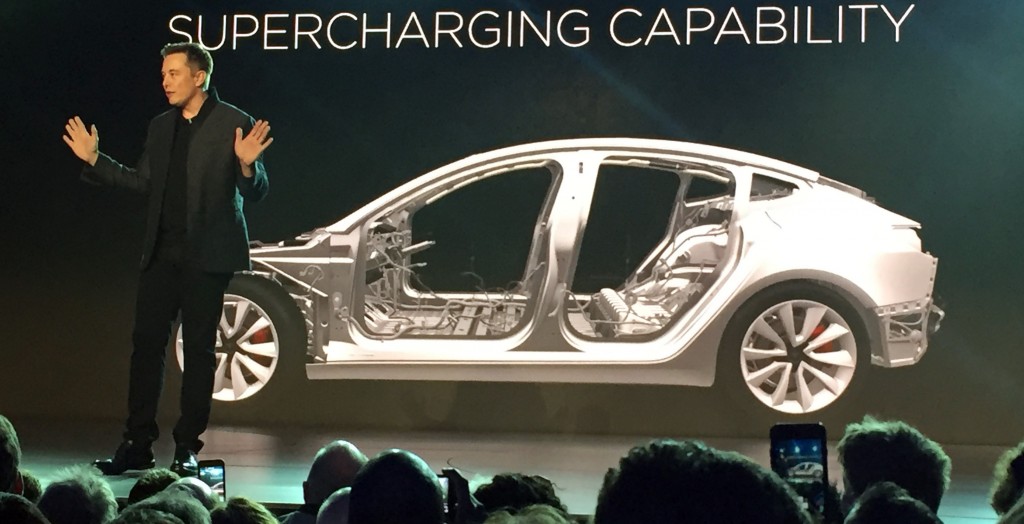

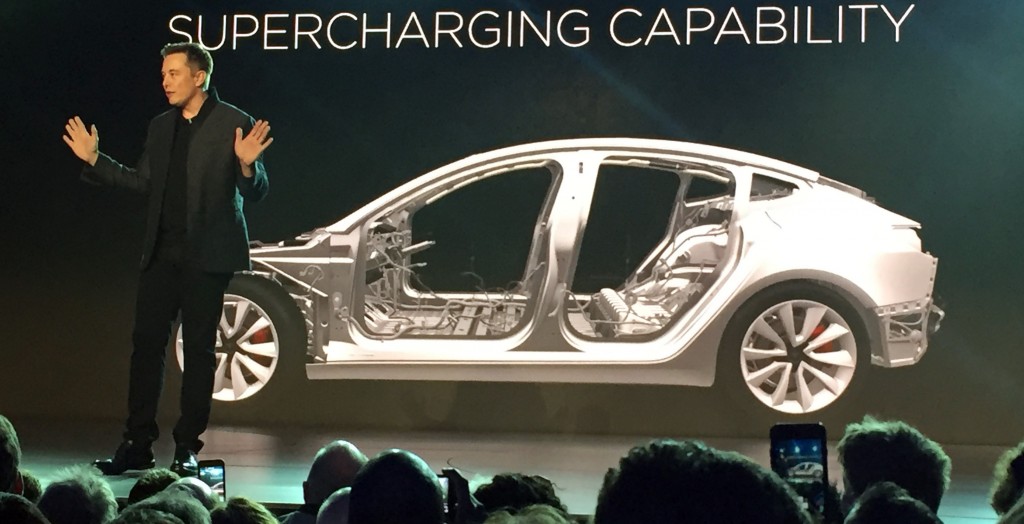

Given how much attention Tesla gets for technology, approach to productivity, (Musk recently said automation was overrated after all and he'd brought more good old-fashioned humans back into his factory), and ambition to make 5,000 Model 3s per week at $35k each, shares will probably bounce back up in no time.

But it does show how much the success of a business depends on shareholders trusting the strategy (and the CEO) – Musk is open about the fact that the company isn't even profitable yet, though he thinks it's 'high time' it gets there soon.