It's pretty hard to be surprised by any new revelations of a very rich or famous person managing to reduce the amount of money they pay in tax.

But just because people aren't surprised, that doesn't mean they're not outraged. The Paradise Papers – a series of recent revelations about the amount of money stored in tax havens by everyone from Bono, to Apple, to the Queen – ignited a two-hour debate in UK parliament, over something they all pretty much agreed on: according to Andrew Mitchell, a Conservative MP, "all parties want to tackle tax avoidance".

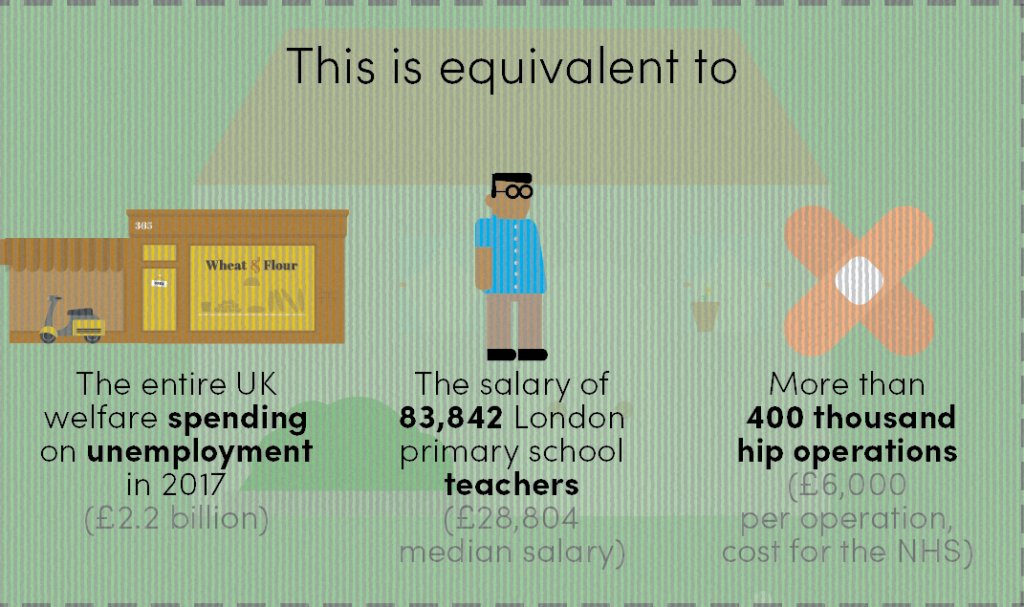

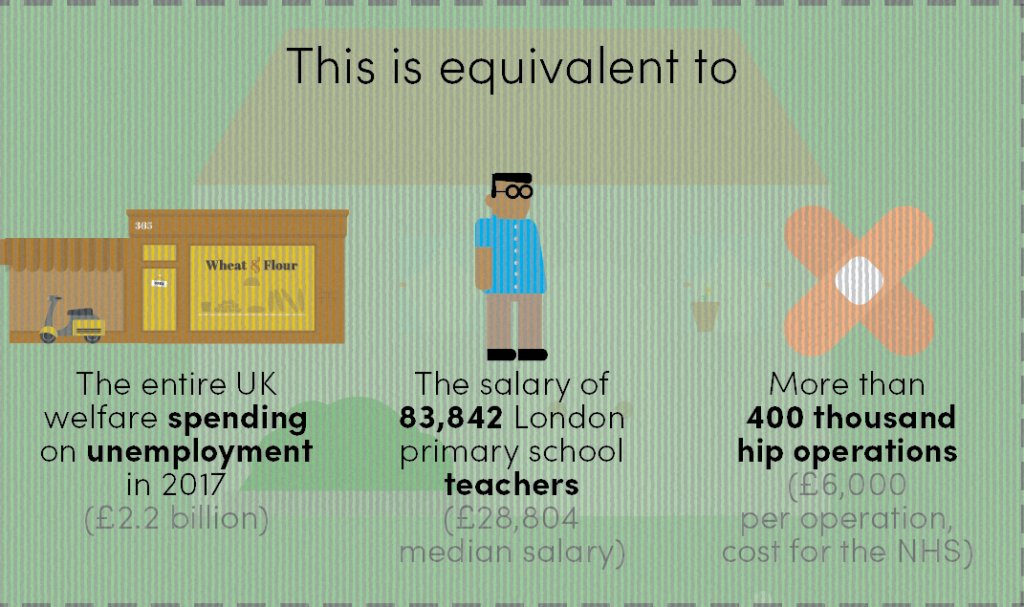

Of course, some economists argue that the assumption this money would go to primary school teachers or hip replacements if it wasn't placed offshore is misleading, because businesspeople might simply not invest as much if they knew they had to pay the full tax. Whether you believe that comes down to your opinions on human behavior and incentives.

It's pretty hard to gauge accurately just how much money is in tax havens right now. Estimates over the amount stored offshore globally vary from $7.6 trillion to $32 trillion (that's trillion!). The UK tax office (HMRC) puts the figure for total money lost to legal tax avoidance at about £4bn annually – offshore 'n' all.