The price of an iceberg lettuce in the UK increased by 67%

The report calculates the changing cost of buying stuff, and from lettuces to laptops to travelling by ferry, it’s got a lot more expensive.

The UK’s big statistics body, the Office for National Statistics (ONS), has gathered data for what it calls its Consumer Price Index, which basically averages out what people (rather than businesses) pay for everyday stuff, and turns it into one figure that shows how prices have increased or decreased – an rate.

This report's a bit different from the last because it includes the cost of housing which the ONS says makes it more representative of what people actually spend their money on.

According to the ONS, the cost of food, of going out, of housing and of transport are higher than they were this time last year.

Kind of confusingly, the prices for February are compared against the prices for February last year, and the prices for January are compared against January last year – they call it the 12-month Index.

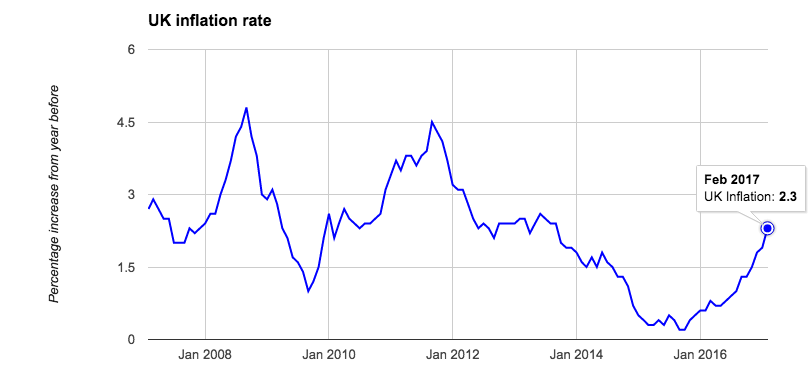

In February, the Consumer Price Index rate was 2.3%, compared to 1.9% in January – the rates have slowly been increasing since the end of 2015.

So, that lettuce

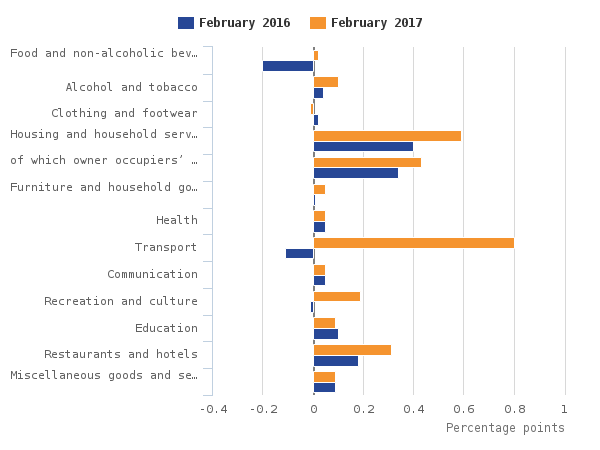

The ONS has broken the price increases down into sectors to show which has the biggest impact, and why the prices might be increasing. You can see from the graph below that some areas have seen much bigger rises than others (transport – wowzers).

Let's look at food first...

These are the first rises in food prices since mid 2014, the ONS said, and were seen across a range of food items. The overall increases aren’t huge, but certain vegetables really jumped in price.

If you’re in the UK, you might remember the courgette (or zucchini, whatever floats your boat) crisis at the beginning of this year. People joked about it being to do with a recent craze for people turning their courgettes in spaghetti – which increased demand. But it was mostly to do with really challenging conditions for growing certain vegetables in some parts of Europe, which decreased supply, so hey presto – big price rise.

The ONS isn’t talking about courgetti though. It’s used the price of an iceberg lettuce which increased by a massive 67.2% between January and February 2017.

...And what's going on with transport

We’ve all gotta get around! And getting around got a lot more expensive – transportation costs increased more than anything else compared to this time last year and the biggest part of that came from rising fuel prices, which is making pretty much all travel more expensive. The ONS also singled out the rising cost of used cars, and increases in coach and sea ferry fares.

How about the price of fun?

The snappily named 'Recreation and Culture' section saw another big rise. One of the biggest price rises came from computers – which is counted in the fun and games category for some reason – which increased by 2.3% between January 2017 and February 2017. In January, for example, Apple told its developers it was increasing prices in the App Store by almost 25% (so a 79p app became 99p) and in October it raised prices of physical products in stores by 20%.

So why is it happening?

Inflation just means prices are going up. In the UK, some of the rise is because the value of the pound has fallen against other currencies – you can read more about that here – which makes it more expensive for the people you buy things from to buy products from other places, and they then pass that rise on to you. Do you remember Marmite-gate late last year? (No? One of the UK's biggest retailers threatened to stop stocking everyone's favourite yeast-based spread because the company that distributes it – Unilever – put its prices up too much, and everybody freaked out) It’s basically that, on a wider scale.

The steady increase in oil prices around the world is also a pretty big part of what’s going on, the ONS said.

And why does it matter?

Most economists agree that a certain amount of inflation is OK. In fact, the goal in the UK is to keep inflation around 2% – so 2.3% isn’t that far off.

Inflation only really becomes a big problem when wages aren’t going up fast enough to match – which means people really feel the effect of those higher prices.

While inflation has been rising, the growth in real wages has been going down. Average wages are only about 1.7% higher than they were last Spring, which is why prices going up 2.3% is a problem.

A group called the Resolution Foundation, which researches living standards, has said that these latest ONS figures are a real concern for people in the UK.

It said: “While there is little that can be done to prevent oil price rises and a falling pound driving up inflation, today’s figures reinforce the risks to living standards of weak wage rises, especially in the context of the recent slowdown in employment growth.”

The government responded by saying it "appreciates the fact that families are concerned about the cost of living", but insists its policies to increase wages for people (like raising the minimum wage) will help.