UKIP’s cheap chips and other weird facts about food taxes

It's official: UK politicians (and/or the UK public) have a weird thing about food. From pretending to like food and clearly failing, to spending way too much time talking about taxes on food, it's a political hot potato (sorry).

Now, it's the turn of the UK Independence Party (UKIP) – in their manifesto launched this week, they've made sure to include a policy to make the Great British fish ‘n’ chips cheaper, by taking the tax off hot food.

Although it doesn’t have any representatives in the UK parliament (MPs), UKIP is actually pretty influential. It was made for one thing and one thing only, to get Britain out of the EU, and it was partly the former prime minister David Cameron’s fear that UKIP was going to steal a load of his voters that meant he decided to hold a referendum in the first place. But now all that’s over, what’s left for UKIP?

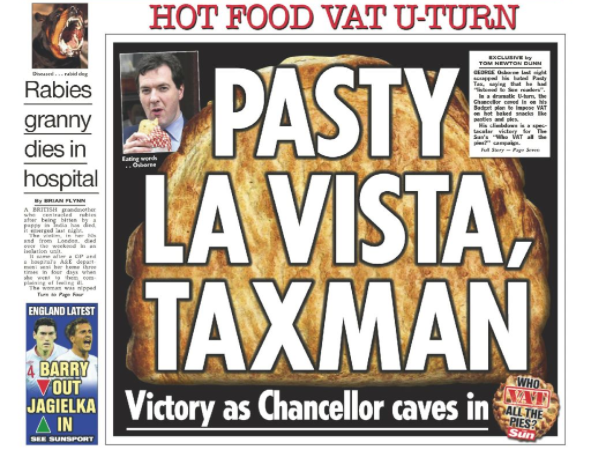

Cheap chips. They’re fighting for our right to cheap chips. But they’re not the first to try and lure in voters by playing around with how food is taxed. In fact, when one politician, George Osborne, tried to simplify the whole system it led to a huge public outcry – honestly it's so big it's even got its own Wikipedia page.

Cheap as chips

Looks like Theresa May got a cone of chips, but no fish, no pasty. You're in Cornwall. For the love of god! pic.twitter.com/gmMNJMN6xi

— Josh Barrie (@joshbythesea) May 2, 2017

UKIP specifically mentioned good old Great British fish and chips in its manifesto. But it’s not just chips – plan is to just remove the tax people in the UK pay on hot takeaway food altogether.

Currently in the UK you pay VAT, a type of tax paid on items you purchase, on hot food so long as it’s hot at the point you buy it, and meets the following criteria:

“It has been heated for the purposes of enabling it to be consumed hot, It has been heated to order, It has been kept hot after being heated, It is provided to a customer in packaging that retains heat or in any other packaging that is specifically designed for hot food, It is advertised or marketed in a way that indicates that it is supplied hot.”

So hot, then. You pay tax on hot food.

Justice for pasties

We know what you’re thinking. Why pay tax on hot food, but not warm food? Why chips, not a toasted sandwich? Why pizza, not a pasty?

Pretty worked up over the injustice of it all, George Osborne (the former chancellor – aka money manager – of the UK) tried to change the policy. In a truly fair world, Osborne thought, people would pay tax on any food “which is at a temperature above the ambient air temperature at the time that it is provided to the customer”.

The problem was, Gregg’s, a UK bakery famous for its pasties, was pretty pissed off. It launched a petition, got half a million pasty lovers to sign it, and delivered it to the government. The government backed down, and the whole thing ended with politicians having to awkwardly eat pasties and have their picture taken to prove that they love pasties just like the rest of us.

When is a biscuit not a biscuit? When it's a Jaffa Cake

Under UK rules, you don’t pay VAT on ‘essential’ bakery items like bread, biscuits and cakes. But here's the catch: add a bit of chocolate to your biscuit, and suddenly it’s a non-essential item, classed as confectionary (which means $$$). Add a bit of chocolate to your cake, and in the eyes of the UK government it is very much still a cake, which is still an essential item, so no VAT. (literally, what?)

Along came Jaffa Cakes. The makers of those orangey, cakey, biscuity, chocolatey deliciousnesses think they are very much a cake (clue’s in the name). The UK government (like the rest of us, TBF) thought that because they look like biscuits, and people eat them like a biscuits, they should be treated like biscuits and you should pay VAT on them. This battle rambled on for so long back in 1991 that it went all the way to the courts. In the end McVitie’s – who make Jaffa Cakes – won. It’s officially, legally, a cake. (Don’t complain to us, we don’t make the decisions).

Funny-shaped packets matter

In the UK, you also pay VAT on all potato snacks – read crisps (or potato chips) but not on say, those beetroot crisps people buy when they’re trying to be healthy. You pay VAT on savoury popcorn if it’s already popped, but not on tortilla chips or twiglets.

Again, we know exactly what you’re thinking: where does that leave Pringles?! They’re not really crisps in the traditional sense (that box, for example, means they look different) and besides, they actually contain less than 50% potato (ew, what?!). In 2008 a judge ruled in Pringle’s favor: the unusual packaging and the low potato content meant they should be exempt from VAT. The government appealed, and Pringles ended up owing millions in tax.