What are Pay Ratios?

What’s the big idea?

Everyone knows there’s a vast chasm between the top and bottom earners in most companies. But are those in charge really more valuable than those who work for them? The pay ratio is pretty much what it says on the tin: a ratio between the highest and lowest paid employees in a company, or the highest and the average median earner. It’s about re-aligning the value of work with how we value the people doing it. The idea is based on the claim that the disparity that exists today isn’t fair, inevitable or even economically practical. Advocates for reform point to reputable studies demonstrating that the link between high pay and performance at work is tenuous at best.

Why should I care?

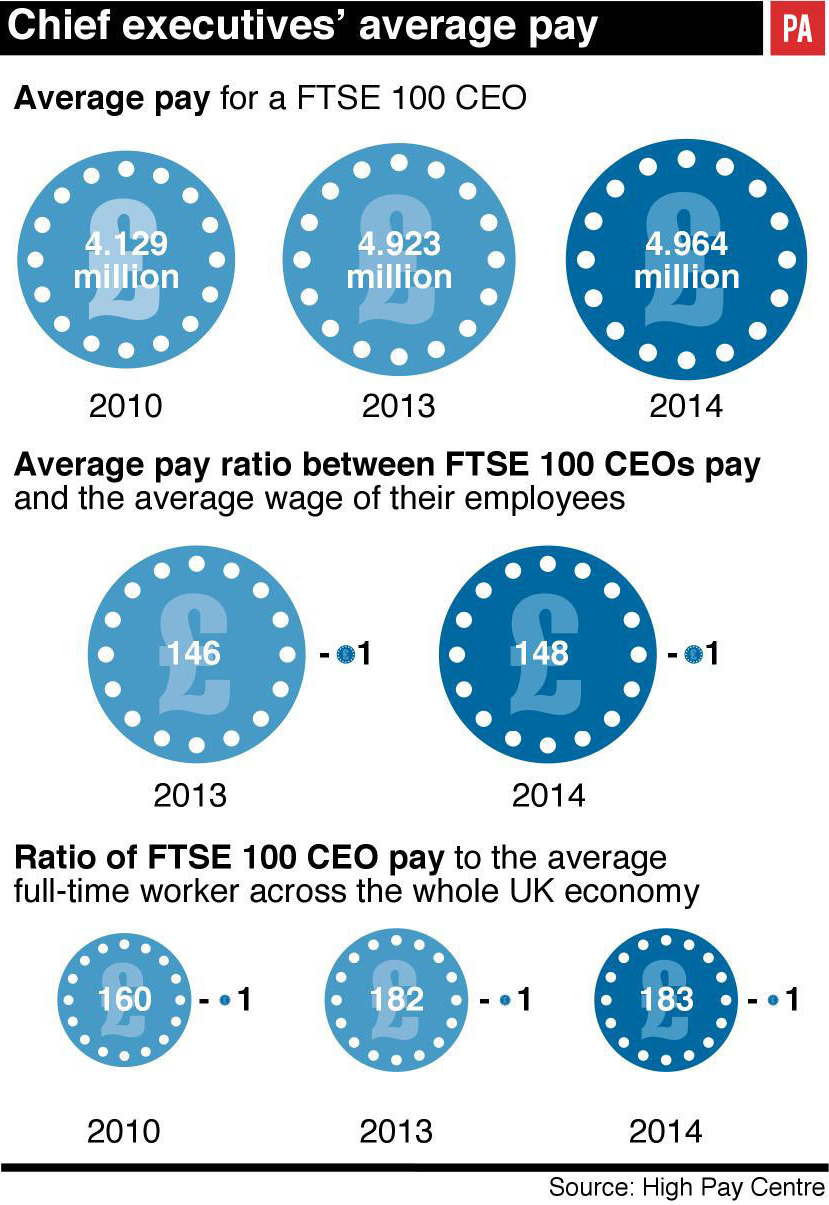

No single life is worth a thousand others. That’s fairly uncontroversial. We’re only likely to hear this debated if, say, there’s a hostage in a war zone, and even then justifications are fraught with moral complications. In 2015 the average FTSE 100 boss’s pay was higher than that of their average employee by a factor of 150. In the UK, for example, real wages have fallen by 8% between 2007 and 2014 for the first time since the 1930s, while CEO pay has risen.

A little history…

In ancient times Plato argued that no Athenian should earn more than 5 times any of his countrymen. More than a century ago, the powerful financier JP Morgan maintained a 20:1 ratio. George Orwell thought 10:1 made sense. Since then, many co-operatives and public companies including Wholefoods, SEMCO and Ben & Jerry’s have or had internal policies to maintain pay ratios. Even the Securities and Exchange Commission in the US has passed regulations on pay ratio reporting and increased shareholder scrutiny of fairness in employee remuneration.

So how does it actually work?

Existing laws already require the compilation of most of the data necessary to construct and publish a rigorous pay ratio. The act of making company pay ratios public would be essentially free. Proponents claim it would encourage easier public and shareholder scrutiny, in the interest of both free trade and the transparency required for democratic participation. While publishing top pay on its own can encourage further excess, the pay ratio could produce more informed debate. On the other hand, enforcing a pay ratio would inevitably be more complex, and controversial. The best numerical value of the ratio is widely disputed, and would have to be agreed on. A pay ratio could be implemented by taxing companies with higher ratios more than those with lower ratios, while possibly redistributing it to lower paid employees so as not to penalise them for board mistakes. Theoretically, this would be rare, if at all necessary, as good company performance would encourage employers to raise their employees’ wages in order to raise their own.

For and against…

Advocates for publishing pay ratios in all companies hope to reintroduce a healthy element of shame and embarrassment, if not humility, into boardrooms. At the same time public, shareholder and employee pressure could bring out-of-control remuneration back into contact with the rest of the workforce, strengthening the sense of community and common purpose pivotal to successful and sustainable industry. Those on the other side of the aisle say a focus on ratios could encourage an outsourcing of work at the lower end of the pay-scale, potentially reducing access to benefits, sick-days and holiday pay. It could also lead to an increase in the number of part-time or zero-hours contracts as the calculations only incorporate regular full-time staff. Those for argue that it would increase equality and hopefully lift many out of poverty. Those against, that the fear of top earnings being reduced could lead to companies leaving any country that implemented it, while tax revenues would also be affected due to the resulting redistribution of wealth – though no-one knows in which direction.

Who’s talking about it?

The closest we’ve seen in recent years to an enforced pay ratio was the Swiss referendum in 2013 to limit bosses’ pay to 12 times their lowest paid employee’s salary. The proposal was roundly rejected, possibly due to the fact that it’s considerably stricter than the TUC’s proposal in the UK of 20:1. The UK, Germany and France have each passed legislation on shareholder scrutiny of pay and binding votes on executive pay, as has the European Commission more recently – which included companies having to justify pay ratios to shareholders. Despite this, most companies are against making pay ratios public. In the US, the 2010 Dodd-Frank Act, and the Securities and Exchange Commission’s ruling in its favour last summer, requires the publishing of executive and average pay in finance in most publicly traded companies. This, despite the SEC’s ruling not taking effect until 2017 has, among other things, led to preferential treatment in awarding government contracts to those with ratios of 100:1 or less.

This article was authored British English